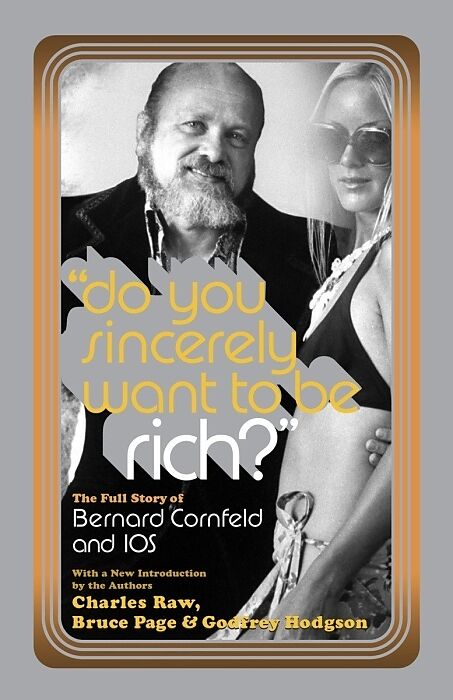

Do You Sincerely Want to Be Rich?

Einband:

Kartonierter Einband

EAN:

9780767920063

Untertitel:

The Full Story of Bernard Cornfeld and I.O.S.

Autor:

Godfrey Hodgson, Bruce Page, Charles Raw

Herausgeber:

Crown

Anzahl Seiten:

594

Erscheinungsdatum:

17.05.2005

ISBN:

0767920066

Zusatztext A splendid story quite splendidly told. . . . [The authors] have researched their subject well; this is no instant history. They savor the drama and the madness! but they stick to business and write with restraint. Cornfeld's girls! castles! and planes come into the story mostly as they contributed to expense. John Kenneth Galbraith! Book World The best book of its kind I have ever read . . . unravels the financial complexity of Investors Overseas Services so skillfully that the general reader will have no difficulty in understanding what happened. New Statesmen A tremendously complex story. . . . [The authors] seem to have poked into every scandal! checked every statistic and interviewed everyone who would talk! from Bernie Cornfeld himself down to the disgruntled employee who told them: 'If anyone was fool enough to put their money with us! that was their problem.' Otto Friedrich! New York Times Book Review Informationen zum Autor CHARLES RAW was financial editor of The Sunday Times (London) when this book was written. BRUCE PAGE , then executive features editor at The Sunday Times , was coauthor of two other bestselling "Insight" books. GODFREY HODGSON was a Washington correspondent for The Observer (London), where for two years he wrote the financial column "Mammon," and was foreign features editor of The Sunday Times . He also coauthored, with Page, American Melodrama: The Presidential Campaign of 1968. Klappentext In the fall of 1955! Bernard Cornfeld arrived in Paris with scant money in his pocket and a tenuous relationship with a New York firm to sell mutual funds overseas. Cornfeld! a former psychologist and social worker! knew how to make friends fast and soon targeted two groups of people who could help him fulfill his economic ambitions: American expatriates who were looking to build their own fortunes and servicemen abroad who loved to live high-rolling lives and spend money. Using the first group as door-to-door salesmen and the second group as his gullible target! Cornfeld built a multi-billion-dollar and multi-national company! famous for its salesmen's winning one-line pitch: "Do you sincerely want to be rich? In this eye-opening yet entertaining book! an award-winning "Insight team of the London Sunday Times examines Cornfeld's impressive scheme! a classic example of good! old-fashioned American business gumption and guile. 1 A Warning to Investors from Mr. Bernard Cornfeld In which we introduce Bernard Cornfeld in the role of international economic statesman and give a preliminary statement of the real nature of Investors Overseas Services. It was Bernard Cornfeld's declared ambition to make Investors Overseas Services the most important economic force in the Free World. The game was mutual funds. Thousands of salesmen, calling themselves "financial counselors," combed the earth for people's savings, and put them into the funds which IOS managed, creaming off enough in the process to make the most successful of them wealthy men. Mutual funds in themselves are an old and well-tried form of investment. A special variant was that IOS was the biggest and best-known of the "offshore" funds. That meant that these funds, and the companies that managed them, were carefully registered and domiciled wherever in the world they would most avoid taxation and regulation. There was nothing new about that either. What was phenomenal about IOS was its success. On the foundation of its offshore mutual funds it built up a complex of banks, insurance companies, real-estate promotions, and every other kind of financial institution you can think of. "Total Financial Service" was the slogan. By the end of the 1960s, Cornfeld's men had a shade under two and a half billion dollars of o...

Autorentext

CHARLES RAW was financial editor of The Sunday Times (London) when this book was written. BRUCE PAGE, then executive features editor at The Sunday Times, was coauthor of two other bestselling "Insight" books. GODFREY HODGSON was a Washington correspondent for The Observer (London), where for two years he wrote the financial column "Mammon," and was foreign features editor of The Sunday Times. He also coauthored, with Page, American Melodrama: The Presidential Campaign of 1968.

Klappentext

In the fall of 1955, Bernard Cornfeld arrived in Paris with scant money in his pocket and a tenuous relationship with a New York firm to sell mutual funds overseas. Cornfeld, a former psychologist and social worker, knew how to make friends fast and soon targeted two groups of people who could help him fulfill his economic ambitions: American expatriates who were looking to build their own fortunes and servicemen abroad who loved to live high-rolling lives and spend money. Using the first group as door-to-door salesmen and the second group as his gullible target, Cornfeld built a multi-billion-dollar and multi-national company, famous for its salesmen's winning one-line pitch: "Do you sincerely want to be rich?” In this eye-opening yet entertaining book, an award-winning "Insight” team of the London Sunday Times examines Cornfeld's impressive scheme, a classic example of good, old-fashioned American business gumption and guile.

Leseprobe

1

A Warning to Investors from Mr. Bernard Cornfeld

In which we introduce Bernard Cornfeld in the role of international economic statesman and give a preliminary statement of the real nature of Investors Overseas Services.

It was Bernard Cornfeld's declared ambition to make Investors Overseas Services the most important economic force in the Free World.

The game was mutual funds. Thousands of salesmen, calling themselves "financial counselors," combed the earth for people's savings, and put them into the funds which IOS managed, creaming off enough in the process to make the most successful of them wealthy men.

Mutual funds in themselves are an old and well-tried form of investment. A special variant was that IOS was the biggest and best-known of the "offshore" funds. That meant that these funds, and the companies that managed them, were carefully registered and domiciled wherever in the world they would most avoid taxation and regulation. There was nothing new about that either.

What was phenomenal about IOS was its success. On the foundation of its offshore mutual funds it built up a complex of banks, insurance companies, real-estate promotions, and every other kind of financial institution you can think of. "Total Financial Service" was the slogan. By the end of the 1960s, Cornfeld's men had a shade under two and a half billion dollars of other people's money to manage, and Cornfeld was publicly announcing plans to push that to $15 billion by the mid-1970s.

By the end of the 1960s, IOS had also made a fortune valued at over $100 million for Bernard Cornfeld personally. It had made around a hundred of his associates millionaires as well. Cornfeld was the most talked about financier in Europe since the Great Depression, and IOS was insistently--and on the whole successfully--asserting the right to sit at the golden table of the world's most respectable financial institutions.

The only trouble was that IOS was not a respectable financial institution. It was an international swindle.

That is not a word which should be lightly used about any organization, let alone one which acquired control over more than two and a half billion dollars of other people's money. We must, therefore, explain precisely what we mean by it.

IOS was the creation of Bernard Cornfeld and Edward M. Cowett. Together these two men built up an organization so steeped in financial and intellectual dishonesty and directed so recklessly that it was absurd that it should have been entrusted with so much of other peopl…

Leider konnten wir für diesen Artikel keine Preise ermitteln ...

billigbuch.ch sucht jetzt für Sie die besten Angebote ...

Die aktuellen Verkaufspreise von 6 Onlineshops werden in Realtime abgefragt.

Sie können das gewünschte Produkt anschliessend direkt beim Anbieter Ihrer Wahl bestellen.

Loading...

Die aktuellen Verkaufspreise von 6 Onlineshops werden in Realtime abgefragt.

Sie können das gewünschte Produkt anschliessend direkt beim Anbieter Ihrer Wahl bestellen.

| # | Onlineshop | Preis CHF | Versand CHF | Total CHF | ||

|---|---|---|---|---|---|---|

| 1 | Seller | 0.00 | 0.00 | 0.00 |